3 x pension Option to exchange part of pension for more cash Option to exchange part of pension for cash at retirement, up to 25% of capital value Some members may have a compulsory amount of lump sum 3 x pension Option to exchange part of pension for more cash Option to exchange part of pension for cash at retirement, up to 25% of capitalLocation Pensions Homepage >> Member Hub >> Leaving or Taking a Break From The Scheme >> Application for a refund of pension contributions (RF12) You, the performer, completes 'Part A' This form can only be sent to us by post, We will log the application within 48 hours of receipt Address Pension Administration, 1 St Annes Road, Eastbourne, East Sussex BN21 3UN NHSGet healthcare cover for travelling abroad BETA This is a new service – your feedback will help us to improve it

Nhs Lease Scheme Page 12 Car Buying Pistonheads Uk

Nhsbsa pension hub

Nhsbsa pension hub-These schemes are administered by the Scottish Public Pensions Agency on behalf of Scottish Ministers and SPPA is also responsible for scheme regulations and for all the administrative tasks required to serve over 175,000 active members, more than 62,000 deferred members and over 100,000 NHS pensioners and dependants who are already receiving benefits from the schemeFor non POL employers the forms are available on our employer hub A joiner excel spreadsheet is available if opting in multiple members of staff Non POL employers send these forms to nhsbsaschemeaccess@nhsnet There is also a new employee questionnaire on the website for you to ensure that eligible members are enrolled in the scheme

Is Your Pension On Track

Consultation on NHS Pension Scheme survivor pensions (England and Wales) The Department of Health and Social Care is consulting on proposals to change NHS Pension Scheme regulations, which include looking to correct the longstanding inequality of male survivors of 1995 Section female scheme members receiving pensions based on post 6 April 19 service onlyGuidance on support for retired members and returning to work in the NHS during the pandemic What you can do in the pensioner hub If you're an NHS pensioner or a surviving spouse, partner or dependant we have information on pensions increase and P60sWhat date do contributions need to reach NHS Pensions by?

Make contribution payments to the NHS Pension Scheme This service is for NHS employers Use this service to make payments for your employees contributions;Location NHS Pensions Homepage >> Employer Hub >> Technical Guidance >> Retirement >> Before you Start >> Forms You May Need >> Retirement Benefits Claim From (AW8) Address Pension Administration, 1 St Annes Road, Eastbourne, East Sussex BN21 3UN Once the AW8 form has been completed by both the performer and NHS Dental Services, the form is sent to NHS Pensions The NHS Pension Scheme is a defined benefit public service pension scheme, which operates on a payasyougo basis A new reformed scheme was introduced on 1 April 15 that calculates pension

Make contribution payments to the NHS Pension Scheme BETA This is a new service your feedback will help us to improve it Make contribution payments to the NHS Pension Scheme Finance login Login detailsYour employer contributions ;Adjustments for previous months;

1

Applying For Your Pension Nhsbsa

The pension commutation calculator shows, for members of the NHS Pension Scheme (Amended April 08) only, what they will receive if they choose to give up (or 'commute') some of their pension in return for a larger lump sum on retirement The additional pension calculator is for members of the NHS and New NHS Pension Schemes considering paying higher contributions inPension Services Our NHS Pension Scheme guidance and support delivers expertise and efficiencies to NHS organisations and their workforces that may not be available inhouse Partnering with some of the largest forwardthinking NHS organisations, our expert team offers specialist knowledge and support to NHS employees, helping to quicklyEngland Infected Blood Support Scheme;

Nhs Pensions Employer Resources Nhsbsa

Your Esr News

Guidance on the Initial Survivors Pension (ISP) is available on the Employer hub This includes who is entitled to it, when to pay it from and how to establish the rate of pension Please note if you are a Direction Employer, you do not need to pay the Initial Survivor Pension This will be paid by NHS Pensions Keywords payment, survivors pension NHSBSA Main Website;Case Study An individual dishonestly continued to obtain their deceased mother's NHS pension by deliberately failing to notify the NHS pension scheme of their mother's death The individual's mother, who received an NHS pensionCOVID19 news for dispensing contractors;

Http Ce Pn Squarespace Com S Practice Managers Update Nov 16 No Ae Pdf

Http Www Fairwaytraining Com Downloads Pips Pips No11 Pdf

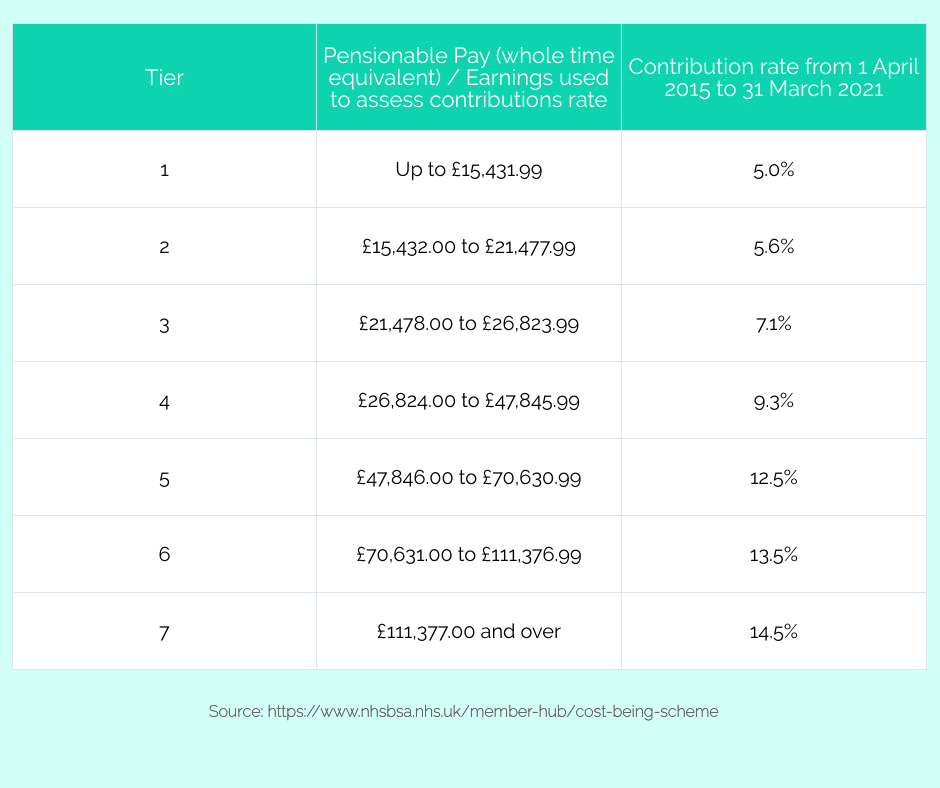

Not clear on the question but if you increase your NHS pension contributions then the short answer is "yes", the long answer is it depends what option you go with, but basically yes (https//wwwnhsbsanhsuk/memberhub/increasingyourpension)NHSBSA Search Search NHS Pensions We're responsible for administering the NHS Pension Scheme in England and Wales Member hub Information for members of the NHS Pension Scheme Employer hub Information for employers of the NHS Pension Scheme Pensioner hub Information for NHS pensioners, surviving spouses, partners or dependants Changes to public service pensionsThe GP Pension Guide provides more detailed information about GPs and the NHS Pension Scheme It is located in the Practitioner webpage (Member Hub section) on our website The Employer Hub section (Technical Guidance) also provides recent employer newsletters and the Regulations Purpose of the certificate and levels of contribution

Final Pay Controls New Form Required Moore Smalley

Assets Publishing Service Gov Uk Government Uploads System Uploads Attachment Data File Nhsbsa Print Pdf

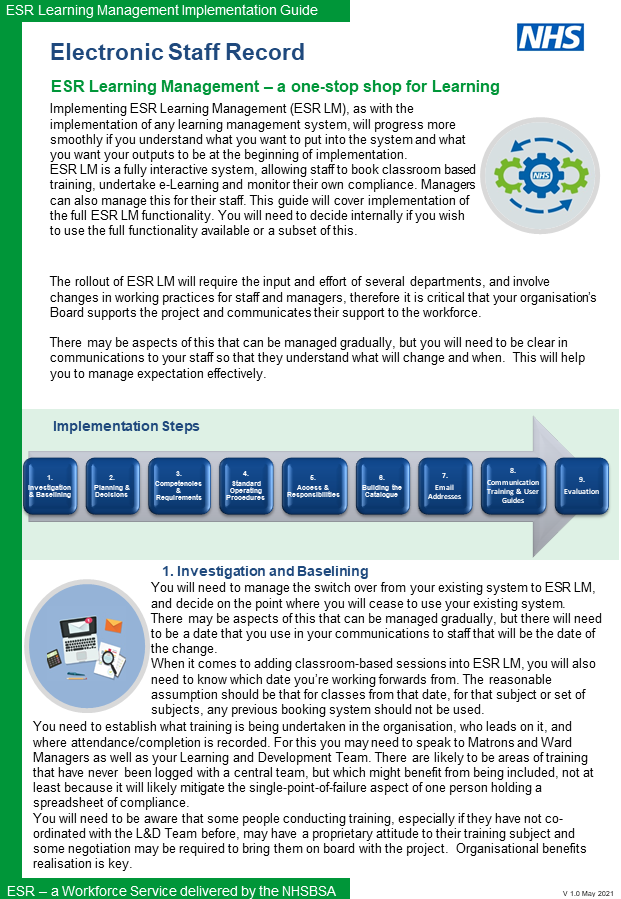

As the workforce solution for the NHS, the Electronic Staff Record (ESR) supports the delivery of national workforce policy and strategy The ESR Hub provides access to the NHS ESR and useful online resourcesIf the growth in your NHS pension benefits exceeds the AA and the charge liability exceeds £2,000 you can elect for NHS Pensions to pay all or some of your AA charge This is known as 'Scheme Pays' NHS pensions must receive the completed Scheme Pays election notice on or before the 31 st July 18 if you declared the AA charge on yourAs the NHS Pensions Agency need your forms 3 months in advance of retirement this gives additional time for your Pensions Team to issue and process the completed forms It is recommended you read the 'Retirement Guide' in the 'Applying for your Pension' section of the NHS Pensions Agency website prior to applying for your pension 6

2

News

NHSBSA, Pension Scheme, Member Hub;To gain access to POL, please visit the Pensions Online (POL) section of the employer hub, click the 'Access Pensions Online' link and then select 'Register' at the bottom of the POL home page You will be prompted to enter your EA code and should then follow onscreen prompts to complete registration process Further details regarding the registration process can be found in theThere is an option to retire early and take your pension at 55 (the minimum pension age), but this usually means a reduction in benefits, as your pension would need to pay out over a longer period There are exceptions though Some members of the 1995 section (including nurses and mental health officers) can take benefits at 55 without penalty, and others can leave at 50 if they had

Unite Nwas Branch Posts Facebook

Browse Content Esr Hub Nhs Electronic Staff Record

Dental Provider Assurance ;Full figures can be found in this NHSBSA document Early retirement factors for Scotland can be found in this NHSPS Scotland document 08 Section If you retire early from the 08 scheme, your pension is reduced as per the table below As a 08 member, you're usually allowed to take up to 25% of the notional fund value as a lump sum – but this is calculated from your pensionWhat you can do in the employer hub You can update and amend member records via Pensions Online (POL) get the forms you need get technical guidance apply for access to the Scheme find information on NHS Pensions Finance use the Electronic Staff Record (ESR) for pensions use our Pensions events calendar to stay informed about NHS Pension

Nhs Pensions Nhs Pensions Twitter

3ekp9iikca Ltm

NHS Pensions LOAs can be emailed 0300 330 1346 https//wwwnhsbsanhsuk/memberhub/contactnhspensionsmembers nhsbsapensionsmember@nhsbsanhsukNHS Help with Health Costs;The NHS Pension Scheme is an attractive benefit for those that work extremely hard in the challenging environment of the country's health service On 1 April 15, some significant changes to the pension schemes offered by the NHS were introduced The kind of deal you get when you retire will depend on when you joined the scheme

Esr Nhs0197 Esr Nhs Pensions Interface Guide Manualzz

Ea O713 Nhs Business Services Authority

Knowledge Base Home The Knowledge Base contains numerous support references, created by our support professionals who have resolved issues for our customers It is constantly updated, expanded, and refined to ensure that you have access to the very latest informationNHS Digital Kit Contribute to nhsbsa/nhspensionprototype development by creating an account on GitHubGitHub Actions makes it easy to automate all your software workflows, now with worldclass CI/CD Build, test, and deploy your code right from GitHub Hosted runners for every major OS make it easy to build and test all your projects Run directly on a VM

Nhs Pension Tax Charges Are You Affected By Annual Allowance Tapered Annual Allowance And How To Calculate Your Threshold And Adjusted Income Medics Money

Nhs Dental Portal Compass Uk Login Database

NHS Digital Kit Contribute to nhsbsa/nhspensionprototype development by creating an account on GitHubThe process for requesting to transfer pension benefits into the NHS Pension Scheme is as follows TransferIn Guide and application pack (Form A and B) is completed and submitted by you to us at the NHS Pension SchemeThe Transfers Team will determine if you are eligible to transfer and estimate the benefits you would receive if the transfer went aheadAn increase to your pension is normally payable if you are over age 55, or if you are in receipt of an ill health pension, an adult dependant's pension or a children's pension The annual increase is based upon the consumer price index (CPI) as laid down by HM Treasury every year Your yearly pension increase is applied by NHS Pensions every April However the date that the increase

Www England Nhs Uk Wp Content Uploads 12 19 Pension Annual Allowance Charge Compensation Policy Quick Guide Clinicians V2 1 Pdf

Www Bfwh Nhs Uk Onehr Wp Content Uploads 16 02 Blackpool Teaching Hospitals Lc17 08 Technology Guide Pdf

If you're an administrator, you'll also be able to manage accounts This process will take around 5 mins to complete Start now Related information NHSBSA Employers HubPensions Online (POL) is an online tool based on the internal NHS Network (N3) It gives employers the facility to update and amend members' pension records Complete our form to make amendments to the Pensions Online administrator details (Word 257KB)If you have any questions about NHS Pensions, contact us by Telephone 0300 330 1346 Outside UK 44 191 279 0571 Monday to Friday, 8am to 6pmFind out about call charges Email nhsbsapensionsmember@nhsbsanhsuk Twitter direct message @nhs_pensions You can write to NHS Pensions, PO Box 2269, Bolton, BL6 9JS

Eput Nhs Uk Publicationwf Pdf Output 5000 Pdf

Nhs Pension Scheme Is It Worth It Wesleyan

Manage my NHS pension Contribute to nhsbsa/nhspensionprototypeswoosh development by creating an account on GitHubNHSBSA NHS Pensions The NHS Business Services Authority (NHSBSA) is a Special Health Authority and an Arm's Length Body of the Department of Health and Social Care (DHSC) We provide a range of critical central services to NHS organisations, NHSIf you have underpaid pension contributions to NHS Pensions, or have overpaid contributions and the amount you need to claim back is less than you would normally pay per month, you should rectify this by adjusting the amount of contributions paid as part of your next monthly submission by the amount that has been overpaid or underpaid Examples of circumstances in which you might

Home Esr Hub Nhs Electronic Staff Record

Home Esr Hub Nhs Electronic Staff Record

For most people the form you will complete depends on if you are still in NHS employment when you come to claim your NHS Pension If you are still in NHS employment you should contact your employer for a Retirement benefits claim form (AW8) which they can get from the Employer HubThis includes if you opted out of the scheme, achieved maximum membership or maximumAnnual end of year pension administration Annual pension forms should be available to download from the NHS Pensions website from early January 19 As part of the requirements of the NHS Pension Scheme Regulations, GPs need to return their GP Provider Annual Certificate of Pensionable Income or the Type 2 Medical Practitioner SelfAssessmentNHSBSA NHS Pensions The NHS Business Services Authority (NHSBSA) is a Special Health Authority and an Arm's Length Body of the Department of Health and Social Care (DHSC) We provide a range of critical central services to NHS organisations, NHS

Nhs Pensions Nhs Pensions Twitter

Eput Nhs Uk Publicationwf Pdf Output 5000 Pdf

Views 126 NHS Pensions publishes a recommended payment schedule on an annual basis advising organisations when to submit their pension contributions to NHS Pensions The schedule can be found on the Employer hubFilename NHS Pensions Member hubjpg Dimensions 1165px * 656px Dimensions 1165px * 656px Filesize KB Filesize KBNHSBSA NHS Pensions The NHS Business Services Authority (NHSBSA) is a Special Health Authority and an Arm's Length Body of the Department of Health and Social Care (DHSC) We provide a range of critical central services to NHS organisations, NHS

Http Ce Pn Squarespace Com S Practice Managers Update Nov 16 No Ae Pdf

Www Nhsconfed Org Sites Default Files 21 06 Pension Annual Allowance Charge Compensation Scheme Faqs For Applicants Pdf

A cornerstone of the NHS' reward package since its creation in 1948, the NHS Pension Scheme is the largest centrally administrated pension scheme in Europe with over 34 million members, and paying over £12 billion annually to its pensionersThe Pensions Regulator Avoid Pension Scams;Information on the new NHS & Social Care Coronavirus Life Assurance Scheme guidance on support for retired members returning to work or increasing commitments What you can do in the member hub In the member hub you'll find all the information you need about being a member of the NHS Pension Scheme

Nhs Pension Planning For Nurses Moneysavingexpert Forum

Home Esr Hub Nhs Electronic Staff Record

NHSBSA, Reduction or Forfeiture of NHS Pension Scheme;

5 Ways You Can Contribute More To Your Nhs Pension Youtube

The Nhs Pension Scheme Doctors Relocate

Is Your Pension On Track

Nhs Lease Scheme Page 12 Car Buying Pistonheads Uk

The Electronic Staff Record Newsletter September Introducing The New Esr Hub As Part Of Nhs Esr S Continued Commitment To Improving The Experience For All Esr Users We Re Making Some Changes To The Esr Log In Page From Monday 5th October

Omars Guidelines Our Pays And Payslips

Www England Nhs Uk Wp Content Uploads 12 19 Pension Annual Allowance Charge Compensation Policy Infographic Clinician Pdf

Nhsbsa Nhs Pensions Providers The Cpd Certification Service

Pensions Time Is Running Out To Reclaim 19 Annual Allowance Charges

Www England Nhs Uk South Wp Content Uploads Sites 6 19 02 Pensions Admin Guidance Flyer V3 Pdf

Sd Number Fill Online Printable Fillable Blank Pdffiller

Pensions Royal College Of Nursing

Pensions Tax And Pay My Supporrt

Nhs Pension Scheme Las Unison

Www England Nhs Uk Wp Content Uploads 12 19 Pension Annual Allowance Charge Compensation Policy Infographic Gps Pdf

Nhs Pensions

Ea O713 Nhs Business Services Authority

Nhs Pension Scheme Las Unison

Answering Nhs Pension Questions Opting Out How To Claim Moving Abroad Etc Youtube

Assets Publishing Service Gov Uk Government Uploads System Uploads Attachment Data File 0819 Nhsbsa Annual Report 18 To 19 Pdf

Password Help Esr Hub Nhs Electronic Staff Record

Nhs Pensions Nhs Pensions Twitter

Www Hee Nhs Uk Sites Default Files Documents Taking personal responsibility for your nhs pension Open Pdf

Www Nhsconfed Org Sites Default Files 21 06 The 19 Pension Annual Allowance Charge Policy Pdf

Joining The Scheme Nhsbsa

Nhs Pension Explained 1995 08 15 Contribution Basis Normal Retirement Age Benefits Etc Youtube

Millions Of Nhs Pre Payment Certificate Holders Could Be Due An Up To 104 Refund For Prescriptions

Pcse England Nhs Uk Media 1096 311 Pensions Admin Guidance V3 Pdf

Nhs Pensions Nhs Pensions Twitter

Mersey Care Staff Benefits

Nhs Pension Scheme Pre Retirement Ppt Download

Nhs Pension Scheme Las Unison

Www Elfsnhs Co Uk App Uploads 06 Nhs Pensions Faqs Pdf

September

Nhs Pension Scheme Pre Retirement Ppt Download

Assets Publishing Service Gov Uk Government Uploads System Uploads Attachment Data File 0819 Nhsbsa Annual Report 18 To 19 Pdf

General Overview Esr Hub Nhs Electronic Staff Record

2

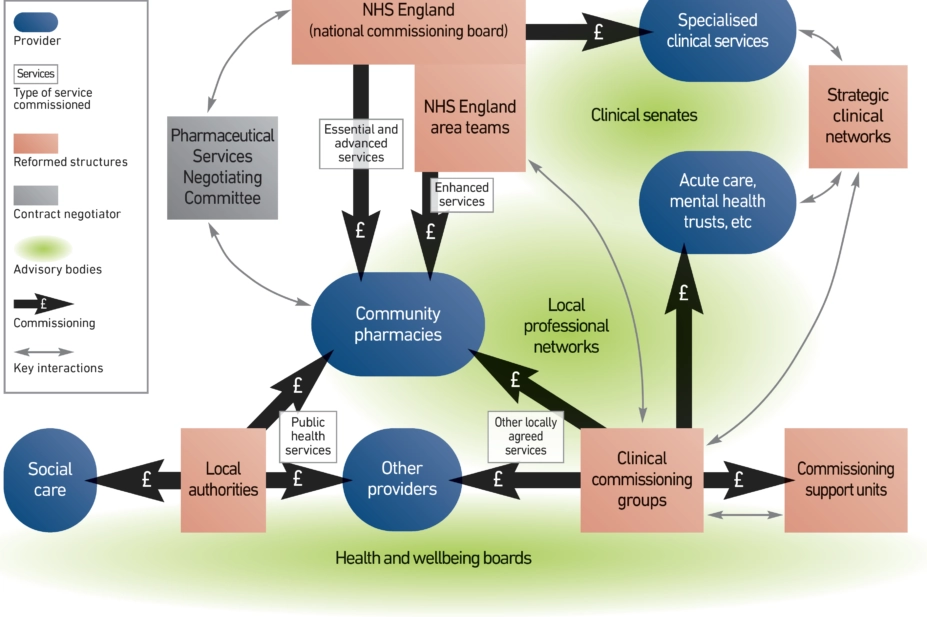

Confused About The Shape Of The Nhs In England The Pharmaceutical Journal

Www England Nhs Uk South Wp Content Uploads Sites 6 19 02 Pensions Admin Letter V3 Pdf

Limited Company Annual Certificate Of Pensionable Income 13 14 Pdf Free Download

Nhs Pensions Nhs Pensions Twitter

24 Hour Retirement Primary Care Support England

Browse Content Esr Hub Nhs Electronic Staff Record

Www Nhsconfed Org Sites Default Files 21 06 The 19 Pension Annual Allowance Charge Policy Pdf

Payroll And Pensions Esr Hub Nhs Electronic Staff Record

Www Blmkccg Nhs Uk Documents Guide To Retirement For Managers And Employees

2

Unison Highland Healthcare Posts Facebook

Nhsbsa Extends 19 Voluntary Scheme Pays Deadline For Nhs Pension Scheme Members With An Annual Allowance Charge

The Transformative Power Of Visualisation Agile Transformation Indigoblue

Browse Content Esr Hub Nhs Electronic Staff Record

Assets Publishing Service Gov Uk Government Uploads System Uploads Attachment Data File Nhsbsa Print Pdf

Www Nhsbsa Nhs Uk Sites Default Files 09 Nhs Pensions Update April V2 Pdf

Www Blmkccg Nhs Uk Documents Guide To Retirement For Managers And Employees

Member Hub Nhsbsa

Www Lgpslibrary Org Assets Bulletins 16 151app4 Pdf

Pseudonymisation And Anonymisation Of Data Policy

Membership Of The Nhs Pension Scheme Nhsbsa

Nhs Pensions All You Need To Know 1995 08 15 Scheme 18 84 Mb 13 43 Free Mp3 Lyrics Download

Janus Financial Consultancy Nhs Pension Scheme

Password Help Esr Hub Nhs Electronic Staff Record

Nhs Pensions Nhs Pensions Twitter

Answering Nhs Pension Questions Opting Out How To Claim Moving Abroad Etc Youtube

2

Nhs Pension Scheme Pre Retirement Ppt Download

Nhs Pension Scheme Pre Retirement Ppt Download

Nhs Pensions All You Need To Know 1995 08 15 Scheme Youtube

Feature Pots And Plans Changes To Nhs Pensions Schemes Mip Trade Union

Feature Pots And Plans Changes To Nhs Pensions Schemes Mip Trade Union

The 15 Pension Scheme

0 件のコメント:

コメントを投稿